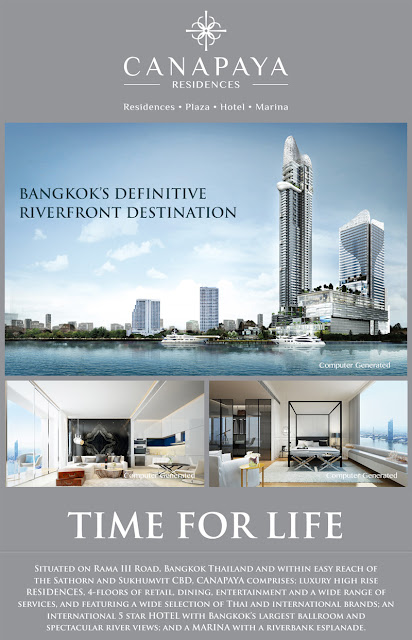

CBRE is pleased to introduce CANAPAYA RESIDENCES, the latest and one of the tallest buildings of all the riverside projects with exclusive private access to yacht pier, situated on the riverside of Rama III Road within easy reach of CBD.

Monday, April 29, 2013

Canapaya Residence (Bangkok)

CBRE is pleased to introduce CANAPAYA RESIDENCES, the latest and one of the tallest buildings of all the riverside projects with exclusive private access to yacht pier, situated on the riverside of Rama III Road within easy reach of CBD.

Monday, April 22, 2013

Reflection - Pattaya

http://orp.co.th/index.php/our-projects/reflection

Reflection is THE first oceanfront super luxury high rise residence in Pattaya located on the quiet Jomtien Beach and only 10 minutes from down town Pattaya. This 55 story 2 tower development offers 180 ocean view units with even private elevators for the larger units and a private sky garden for every duplex unit. With outstanding facilities which includes 5 different pools, tennis courts, putting green and fitness center and last but not least underground parking and open lobby, makes this an developments which stands out from all and everything else.

Wednesday, April 10, 2013

Real Estate News

Since the beginning of the global credit crunch in 2008, luxury real estate has morphed into a new world currency that provides investors with both a tangible asset and a cachet that cannot be found within the financial markets. It’s as if these emboldened investors zoomed out of their local Google Earth view to discover the wider global perspective on luxury real estate.

Read more...

Thursday, December 23, 2010

Monday, March 22, 2010

Maha Nakhon Building (Bangkok)

MahaNakhon—a visionary new 77-storey high-rise complex located on a 3.6 acre site in the heart of Bangkok’s Central Business District with a direct link to the Chongnonsi BTS Skytrain station between Silom and Sathorn Roads.

MahaNakhon—a visionary new 77-storey high-rise complex located on a 3.6 acre site in the heart of Bangkok’s Central Business District with a direct link to the Chongnonsi BTS Skytrain station between Silom and Sathorn Roads.Monday, July 21, 2008

Office growth mirrors the economy

The growth in Bangkok’s office market increased in line with the remarkable development of the Thai economy in the late 1980s and early 1990s, as the total supply of office space expanded from around 1.5 million square metres in the early 1990s to about 7.5 million sq m currently.

The growth in Bangkok’s office market increased in line with the remarkable development of the Thai economy in the late 1980s and early 1990s, as the total supply of office space expanded from around 1.5 million square metres in the early 1990s to about 7.5 million sq m currently.Companies began to realise the advantages of having quality offices in terms of location, convenience, prestige and effects on employee productivity. Thailand’s economic revolution drove demand for increased office space, and office projects began to offer better premises and facilities, including central air-conditioning, higher ceilings, and improved building floor plates. Tenants and developers soon moved away from office condominiums, as the strata title of such developments made it more difficult to offer seamless building management and services.

Bangkok’s Central Business District (CBD) is now defined by CB Richard Ellis as the area incorporating Silom, Sathon, Surawong, Rama IV, Phloen Chit, Wireless, early Sukhumvit, and Asok roads, and sois in between, but in the early days, the CBD was synonymous with the Silom area. During the 1990s, Thaniya Plaza was one of the most sought-after addresses, with monthly rents of 800-900 baht per square metre. As development increased, the CBD expanded to Sathon and Rama IV, where both the U Chu Liang Building and Abdulrahim Place are located. Opened in 1995, Rama Land Building was one of the first mixed-use developments in Bangkok, combining office, hotel and retail space. Office projects also sprouted up in the diplomatic area of Wireless Road, with All Seasons Place, another mixed-use project, a landmark in this area.

Before the Asian financial crisis, Thailand was one of the most attractive Asian economies for foreign investment, which fuelled demand for and growth in the office sector. However, the 1997 crisis led to many finance companies closing, pushing up vacancies, while other office projects that were under construction were suspended, or in some cases, abandoned as developers ran out of funds. The oversupply worsened in late 1998, and the total supply of roughly 6.3 million square metres suffered through vacancy rates of more than 30%. Vacancies were more pronounced in the CBD.

Some of the buildings suspended during the crisis were later revived by investors who purchased them at a bargain and completed the projects. Q House Lumpini, one of the most prestigious buildings in Bangkok today, was one such case. Other examples include the soon-to-be-completed Chamchuri Square (formerly C.U. Hightech Square), and Exchange Tower, located at the Asok-Sukhumvit junction.

The landscape for office development has changed since the crisis in many ways, as developers recognise the need to distinguish their products in order to compete. Design, facilities and services have all improved. More attention has been paid to the need for regular floor plates to eliminate wasted space. As companies have focused on cost savings, there has been a move toward smaller, more efficient offices, which requires floor plans that allow for easy subdivision. Most new buildings now offer higher ceilings, along with designs that cut down on noise.

Office rents in Bangkok are low when compared to other major cities both regionally and internationally. According to a recent CBRE report, office rents in Bangkok are the lowest of any major city in Asia, with the exception of Jakarta and Kuala Lumpur, and only a fraction of those in Hong Kong and Singapore.

Occupancy rates are now high in Bangkok (close to 90%), and given continually rising construction costs and the scarcity of quality CBD land, we believe that rents will have to increase soon as demand increases, and also in order to make future development worthwhile. Bangkok’s CBD is now firmly anchored by the BTS and MRT systems. Although office space outside the CBD can be had at a 10-30% discount over CBD space, this is a much smaller difference than in most other cities.

Going forward, demand for Bangkok office space will be driven by the country’s growing services sector. Any changes in regulation that encourage foreign participation would accelerate this growth. At the moment, Thailand lags many of its competitors in terms of the incentives given to international companies for setting up in Thailand, but we are hopeful that this will change as the country adopts to an increasingly competitive global economy.

Tuesday, July 8, 2008

High-end broker E&V aims for Bangkok market growth

The upmarket residential brokerage Engel & Vo¨lkers (Thailand) Co plans aggressive expansion within this year by opening about 10 new outlets in Thailand, including seven in the competitive Bangkok market.

The upmarket residential brokerage Engel & Vo¨lkers (Thailand) Co plans aggressive expansion within this year by opening about 10 new outlets in Thailand, including seven in the competitive Bangkok market. Managing director Martin Phillips said the company next month would open a shop in Samui to list both new and existing units offered for sale.

It also plans to add another shop in Phuket, where E&V opened its first outlet in late 2005. The company is also negotiating to open a shop in Pattaya.

As well, E&V is holding talks with prospective franchisees in Bangkok on the division of territory, to ensure that each one would have more or less equal business opportunities in operating a residential brokerage.

Each investor needs to pay 2.5 million baht for a 10-year contract plus an annual royalty. Normally, it takes about three months to set up a shop and fit the site to conform with the Engel & Vo¨lkers universal look. The company helps to find the location but the investor needs to negotiate the lease terms.

Engel & Vo¨lkers will apply a submarket strategy in the capital, with shops in the central business district as well as suburban locations such as Lat Krabang and Rarm Intra where there are many new residential units with quality meeting the company’s listing standard.

Garry Irvin, the company’s expansion manager, said investors saw the opportunity to enlarge their business with good returns in the future.

Engel & Vo¨lkers worldwide currently has 333 residential shops and 32 commercial offices in 25 countries. It has sold 435 licences in all so more than 100 shops are still in the process of being established. The brand’s turnover last year was 160.7 million.

Its statistics show that the average fee earned by licence holders is 250,000 in the first year of operation and increases to 400,000, 600,000 and 750,000 in subsequent years.

Mr Irvin said that franchisees benefited from a well-recognised brand, and a turnkey operation that the company supports in terms of establishment, coaching and training, and a global network.

‘‘Although we are growing the network and are close to signing certain deals, we do still have some prime territories available,’’ he said.

In Bangkok, E&V will focus on resales first and later start to list new units, which require a different set of skills.

Mr Phillips believes Engel & Vo¨lkers has no direct competitor in Bangkok. He said the capital’s residential resale market was fragmented with local and international brokerages but there was no operator in the same style as E&V.

The company believes that its submarketing strategy creating brand awareness in designated territories will bring about good brand acceptance within one year. It forecasts that 70% of transactions would involve Thai customers and the rest foreign customers buying units in Thailand.

Engel & Vo¨lkers’ research also indicates that 40% of customers purchased units through its shops because they were attracted by the shop design, so the company in Thailand hopes to repeat the proven success in other countries.

Mr Phillips, who opened the first shop in Phuket and is the master licence holder for Southeast Asia, said his shop last year sold assets worth more than one billion baht and he expects stronger sale this year, as the high-end market in Phuket is still firm. He plans to invest in a second shop in Phuket.

The company is also working on granting licences in other countries such as Vietnam, the Philippines and Singapore.

Weak demand forces a switch from Thailand

TCC Capital Land is focusing on Vietnam, which it sees as a very promising market, while scaling back launches in Thailand from four to two a year.

TCC Capital Land is focusing on Vietnam, which it sees as a very promising market, while scaling back launches in Thailand from four to two a year.The joint venture between Singaporebased CapitaLand and liquor billionaire Charoen Sirivadhanabhakdi’s TCC Land might further reduce launches in Thailand next year depending on the overall situation, says CEO and managing director Chen Lian Pang.

‘‘So our emphasis is market demand. If there is a demand, we will go ahead. If there is no demand, we will pull back,’’ Mr Chen said. ‘‘We are very flexible because ours is not a listed company so there is no pressure to produce certain amount of revenue.’’

Aside from Vietnam, TCC Capital Land is also keen on India because it considers other key regional countries such as China, Australia and Singapore to have matured.

Among Vietnam’s attractions is its population of 85 million, 60% of whom are under 30 years of age.

‘‘There is a lot of potential and a big mismatch between supply and demand. For instance, over the next three years Ho Chi Minh City requires about six million square metres of housing supply but the supply is only about 1.9 million — a big gap.

‘‘Hanoi is the same. Over the next three years they need about three million square metres but the supply is only about 1.3 million. So the fundamentals there are right.’’

This clearly means that TCC Capital Land will be focusing on the local Vietnamese market, not expatriates, who might be keen on buying villas there. Foreigners are permitted 50-year leaseholds and not freehold in Vietnam.

Mr Chen drew attention to cultural differences, noting that only 15% of property buyers in Hanoi obtain mortgages. The rest pay in cash either by borrowing from relatives or pooling their resources together in order to make the purchase. The trend indicates there is a lot of hidden wealth in the country.

Both China and Vietnam appeal to foreigners. Unlike Thailand, where foreign developers cannot own more than 40% in a company in order to buy land, these two countries do not impose such a restriction. China only requires local participation but not stating the level. Even Malaysia allows foreign developers to own up to 49% in a company.

‘‘In this sense, they [Thais] are losing out to neighbouring countries.’’

Also whether Singaporean investment in Thailand increases or not depends on the return they would obtain. Mr Chen pointed out that most of them sought a yield of 8% to 10%, with 6% seen to be on the low side.

In any case, Mr Chen believes that the region is expected to continue to feel the impact of the US sub-prime crisis for some time, perhaps one to two more years. Personally, he feels the worst is not over.

The slowdown has affected demand in Thailand, as witnessed by the company over the last two years. Even so, prices are unlikely to drop.

In this environment, it is possible that financially weak or heavily leveraged companies might run into trouble and TCC Capital Land is actively looking for opportunities both within Thailand and across the region.

Mr Chen believes many people might be better off to hold cash for now, but if they do want to commit to property, they may see more clarity in the market later this year.

‘‘But of course the price of good property doesn’t go down. For instance, for TCC Capital Land I don’t think we will drop the prices even if we are not able to push sales. We will wait. Property is basically about timing. If you wait, the price will recover.’’

After perching at the high end for some time by launching a string of posh projects such as Athe´ne´e Residence and Emporio Place, TCC Capital Land dramatically moved to the middle segment recently with its new brand S&S, which stands for sufficiency and sustainability. Its first mid-range project is S&S Sukhumvit located on soi 101/1. This project covers more than six rai of land and consists of two condominium towers, 18 and 22 stories, with a total of 810 units. These range from 29.5-squaremetre studios to 68-square-metre twobedroom apartments with prices starting at 1.279 million baht.

TCC Capital has carefully planned its entry into the middle market. Aside from the eco-friendly focus, it plans to be within one to two kilometres of a BTS station, something that is very appealing to this group of buyers.

Mr Chen finds investing in Thailand to be very different from in his native Singapore. Thais are more pricesensitive than Singaporeans. Also, tastes differ with people here preferring more traditional and classical styles while Singaporeans tend to closely follow international trends.

While studios, one- and twobedroom units near the BTS stations are currently popular among Thais, the trend in Singapore before the recent slowdown kicked in was for bigger apartments.